Recently, the international Organisation for Economic Co-operation and Development (OECD) published that the global economy is projected to remain subdued in the second half of 2022, before slowing further in 2023 to an annual growth of just 2.2%.

While the world economy is declining, many countries are navigating energy shortages, supply chain disruptions, the effect of inflation on the cost of living, and uncertain political conditions. As a result, marketing budgets are at risk of being slashed.

Although the 2022 Gartner CMO Spend and Strategy Survey indicate that budgets have recovered slightly this year, they still lag behind pre-pandemic figures. The average marketing spend increased from 6.4% to 9.5% of company revenue across most industries; however, between 2018 and 2020, they averaged 10.9%.

The Gartner report shares, “Financial services, travel and hospitality, and tech product companies stand out, recording budget increases at 10.4%, 8.4% and 10.1% of company revenue, respectively. In contrast, spending for consumer goods CMOs decreased slightly from 8.3% in 2021 to 8.0% in 2022.”

According to The CMO Survey released in September 2022, “about 66% of US marketers said they were less optimistic about the third quarter of 2022 than the second quarter. Only 12% of marketing executives said they considered themselves more optimistic about the third quarter.” A significant 42% of companies have cut their marketing expenditure.

Brand communication budgets are often a casualty of economic downturns, but knee-jerk cost-cutting is a mistake. The ROI Genome Intelligence Report by marketing intelligence provider Analytic Partners revealed that “marketers who cut spend risk losing 15% of their revenue during a recession.”

In 2009, I had the privilege of working with Simon Silvester, Head of Planning at ad agency Y&R. He authored quick reads for marketers to help steer their way through the marketing challenges of the time.

‘AAAGH!: A Deep Recession Changes Everything’ was published to shed light on how brands should approach the worldwide economic crisis. He described how tough economic times act as a full-stop in the consumers’ psyche; as such, they become anxious, confused and unhappy and, therefore, more frugal in their buying decisions. Herein lies the opportunity for brands.

“Now is not a time to cut ad budgets – it’s time to spend on innovation.” – Simon Silvester.

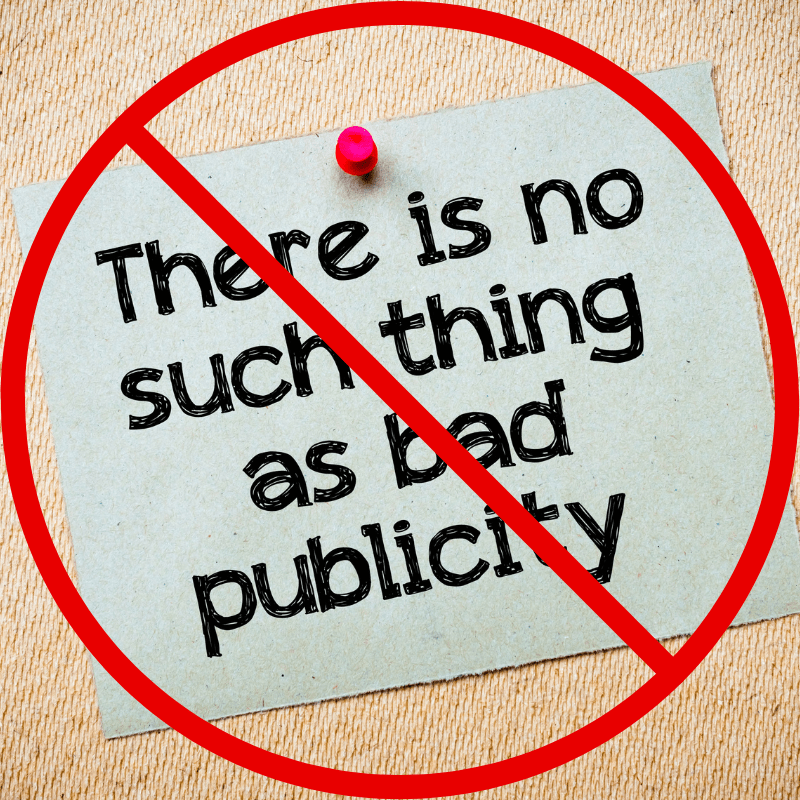

While many believe that this is a time to slash budgets, Silvester suggested taking calculated risks and making your brand much more visible than it would have been before. Consumers don’t close themselves off forever; they lie low and temporarily dormant. When competitors go quiet, your brand gains a share of mind with a bigger audience to engage with.

This is affirmed by Analytic Partners’ report, which highlighted that “60% of brands that increased media investment during the last recession saw ROI improvements.” Further, it revealed that “brands that increased paid advertising saw a 17% rise in incremental sales, and that brand messaging outperforms performance messaging 80% of the time.”

Other key take-outs prove that using multiple marketing channels can increase advertising impact by 35%. Half of the brands that increased marketing investment during the last recession saw ROI growth in back-to-back years.

Lessons from history

Kellogg’s profits grew by 30% during the Great Depression after doubling its advertising spend on radio and introducing Rice Krispies (a new cereal at the time). Kellogg’s became the category leader, which they’ve maintained since.

In the 1930s, still, during the Great Depression, Proctor & Gamble continued to invest in advertising, turning Oxydol into a household name. They achieved this by launching light-hearted drama stories targeting women (this is where the term ‘soap opera’ originated), allowing them to thrive while competitors survived.

Fast forward to the 1990 recession, when McDonald’s dropped its advertising and promotion budget, Pizza Hut and Taco Bell increased spend and, therefore, sales by 61% and 40%, respectively. McDonald’s sales declined by 28%.

And in 2019, when Samsung maintained marketing investment and rebranded as an innovative company, it shot up in brand value among Interbrand’s global list from being ranked No. 21 to sixth place.